See This Report on Virtual Cfo In Vancouver

Wiki Article

A Biased View of Pivot Advantage Accounting And Advisory Inc. In Vancouver

Table of ContentsSmall Business Accounting Service In Vancouver Fundamentals ExplainedThe Ultimate Guide To Tax Consultant VancouverThe Single Strategy To Use For Tax Consultant VancouverUnknown Facts About Small Business Accountant Vancouver

Because it's their work to keep up to day with tax codes as well as guidelines, they'll be able to suggest you on just how much cash your business needs to place apart so there aren't any surprises. Before you go nuts an audit isn't always poor! The feared "internal revenue service audit" takes place when a company isn't submitting their taxes properly.

When it involves preparing for any audit, your accountant can be your ideal good friend since they'll conserve you lots of time planning for the audit. To stop your business from obtaining "the poor audit", below are some pointers to adhere to: File as well as pay your taxes in a timely manner Don't inaccurately (or forget to) documents company sales and also invoices Do not report personal costs as overhead Keep precise service records Know your certain company tax obligation reporting obligations Suggested analysis: The 8 Many Common Tax Obligation Audit Causes Quick, Books After evaluating the standard audit and also bookkeeping solutions, you're probably questioning whether it's something you can handle yourself or require to hand off to a specialist.

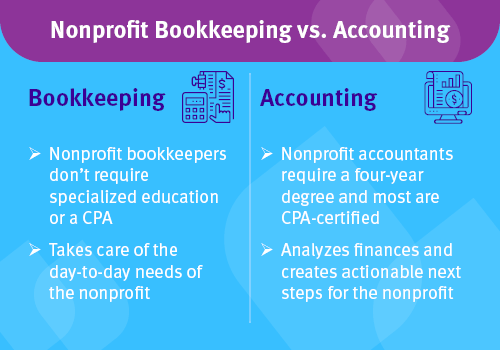

For instance, will you require to prepare once a week or monthly financial reports or only quarterly and also annual reports? An additional factor to think about is monetary understanding. Is there someone in your office that is qualified to deal with important bookkeeping and bookkeeping services? If not, an accountant may be your safest bet.

Accountants are rather adaptable and can be paid per hour. Additionally, if you do decide to contract out accountancy and bookkeeping services, you would not be accountable for providing advantages like you would certainly for an internal worker. If you make a decision to work with an accountant or accountant, below are a few suggestions on discovering the right one: Examine references and also previous experience See to it the candidate is educated in accounting software application and innovation Make certain the prospect is fluent in accounting plans and also treatments Examine that the candidate can clearly connect financial language in words you comprehend Ensure the prospect is sociable as well as not a robotic Local business proprietors as well as business owners commonly contract out accountancy and also accounting services.

Examine This Report about Tax Accountant In Vancouver, Bc

We compare the most effective below: Swing vs. Zoho vs. Quick, Books Don't forget to download our Financial Terms Rip Off Sheet, that includes essential accountancy and also accounting terms.

Ultimately, you will certainly supply us with accurate quantitative information on economic setting, liquidity and also money circulations of our company, while guaranteeing we're compliant with all tax obligation regulations. Take care of all audit purchases Prepare budget plan projections Release try these out financial statements in time Take care of monthly, quarterly and annual closings Reconcile accounts payable and receivable Ensure timely financial institution repayments Calculate tax obligations and prepare tax returns Manage equilibrium sheets and profit/loss statements Report on the company's financial wellness as well as liquidity Audit economic purchases and documents Strengthen financial information discretion as well as conduct data source back-ups when needed Comply with monetary plans as well as policies Work experience as an Accounting professional Superb knowledge of accounting policies and also procedures, consisting of the Normally Accepted Audit Principles (GAAP) Hands-on experience with bookkeeping software like Fresh, Books as well as Quick, Books Advanced MS Excel abilities consisting of Vlookups and also pivot tables Experience with general ledger features Strong attention to information and excellent logical skills BSc in Audit, Finance or relevant degree Extra qualification (CPA or CMA) is a plus What does an Accounting professional do?

The accountant movie run time responsibilities of an Accountant can be fairly comprehensive, from auditing economic papers as well as conducting financial audits to fixing up bank statements and computing taxes when filling up out annual returns. What makes an excellent Accountant?

Who does Accounting professional work with? Accountants deal with magnate in little business or with managers in huge companies to ensure the top quality of their economic documents. Accountants may likewise work together with specific group leaders to obtain and also examine monetary documents throughout the year.

4 Easy Facts About Small Business Accounting Service In Vancouver Described

The term audit is really usual, particularly during tax obligation period. However before we dive right into the relevance of audit in business, allow's cover the fundamentals what is accountancy? Accounting describes the methodical and in-depth recording of financial purchases of a company. There are numerous kinds, from making up local business, government, forensic, and monitoring bookkeeping, to making up companies.

Laws and policies differ from state to state, yet proper accountancy systems as well as processes will certainly aid you guarantee statutory compliance when it pertains to your organization (small business accounting service in Vancouver). The accounting function will certainly make certain that liabilities such as sales tax obligation, VAT, income tax obligation, as well as pension plan funds, to name a few, are properly dealt with.

Service trends and forecasts are based on historical economic information to keep your operations lucrative. Organizations are required to submit their financial statements with the Registrar of Business.

The 3-Minute Rule for Vancouver Accounting Firm

Report this wiki page